MANAGING RISKS

BUILDING RESILIENCE AND SAFEGUARDING THE BUSINESS

Risk Management Framework

Risk Management Framework has encapsulated company’s approach towards Risk Management and defined practises for the same. Risk Management policy, procedure and plans guide Business operations to deal with risk matters proactively.

Role of the Risk Management Committee

Board Risk Management Committee and Executive Risk Management Committee help in keeping an oversight on risk management activities across the organisation. Robust Governance thus instituionalised helps to stay the course while pursuing organisational goals.

Risks and their Mitigation Measures

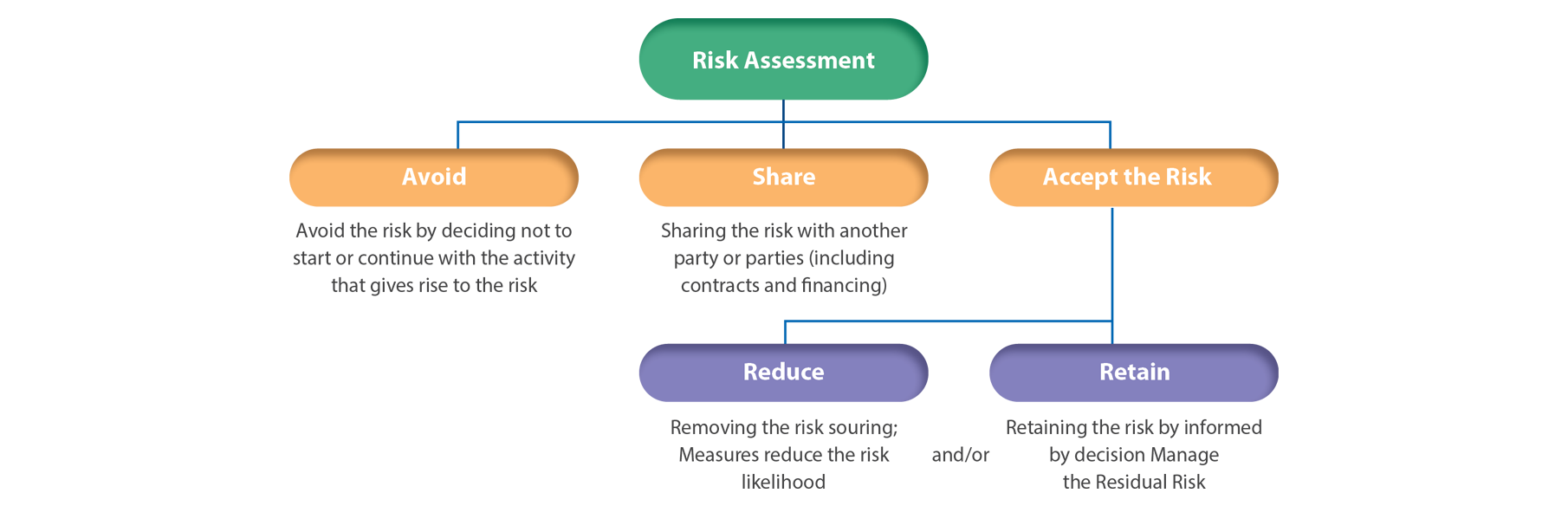

Most impactful risks are identified and appropriate remedaition measures are undertaken to reduce the risk exposure. Cost effective mitigation measures are deployed to prevent and protect from plausible incidents/ accidents.

From a risk management perspective, our key objective is to build a resilient organization and through implementation of best-in-class risk management processes. That is the objective of the whole function of risk management. And that is what we are looking to achieve as an organization.

An integrated Risk Management program has been rolled out to acknowledge and address risk at every level

|

Company Level Risk Management

Risk Universe L-1 |

|

|---|---|

|

SBG Level Risk Management

Risk Universe L-2 |

|

|

SBG/ Project Level Risk Management

Risk Universe L-3 |

|

Few notable risks are mentioned below along with respective risk response.

| Risk | Risk Definition | Our Response | Strategic Objective |

|---|---|---|---|

| Data Protection Risk | Failure in maintaining integrity, availability and confidentiality of Business Critical information may cause loss, disruption and rework. |

|

Business Continuity is enhanced by making right information available to right persons at right time. |

| Business Portfolio Risk | A sizeable chunk of the business comes from Government entities and Public sector companies. There is a Revenue concentration due to this. |

|

Diversification of clients to attain sustained revenue growth |

| Climate Change Related Risk | There is an evident shift to Green energy choices, encouraged by favourable Government policies. EPC companies need to build capabilities to sustain this shift. |

|

Sustainability of Growth and fulfillment of Environmental goals committed by the Tata Group |

Other key risks faced which are actively managed are:

- Commodity Price Risk

- Labour Availability at Remote Sites

- Political/ Regulatory Changes

- Failure of Sub-Contractors